Bitcoin Trading Geeks – Blockchain Solutions in Austin, TX

At Bitcoin Trading Geeks, based in Austin, Texas, we specialize in blockchain-based trading solutions tailored for forward-thinking investors and businesses. Our mission is to provide cutting-edge financial tools and crypto strategies designed to help you thrive in the fast-evolving digital asset landscape. Whether you’re navigating volatile markets or building long-term portfolios, our team delivers data-driven insights, institutional-grade analytics, and personalized advisory with integrity and precision.

How We Empower Investors and Businesses

We go beyond generic crypto advice. Our tailored strategies are designed to help you trade smarter, minimize exposure, and maximize return in digital markets.

Market insights and research

Stay informed with in-depth reports on Bitcoin price trends, market sentiment, and macroeconomic triggers. Our research includes on-chain metrics, miner behavior, and derivatives data to give you a competitive edge.

Risk management strategies

From stop-loss optimization to volatility modeling, our frameworks help you guard capital in turbulent conditions. Historical data suggests that consistent application of risk controls may reduce portfolio drawdowns by over 30%.

Portfolio optimization

We use real-time analytics and proprietary models to optimize your crypto asset allocation. This includes rebalancing based on Sharpe ratios, liquidity scores, and regulatory impact assessments.

Financial planning solutions

Crypto wealth needs long-term vision. Our team builds structured plans integrating tax efficiency, multi-jurisdictional holdings, and inheritance planning tailored to digital assets.

Comprehensive Financial Services

We offer a full suite of crypto-native and traditional financial services to support both private investors and institutional clients.

Investment advisory

Benefit from unbiased, data-backed crypto investment strategies. From DeFi to large-cap coins, our advisors build strategies suited to your goals and risk tolerance.

Corporate finance solutions

We assist blockchain startups and fintech firms with tokenomics design, fundraising strategies, and cap table optimization—critical for long-term sustainability.

Advanced financial analytics

Leverage machine learning tools and custom dashboards to analyze trends across exchanges, wallets, and chain activity—empowering smarter decisions in real time.

Wealth management

Protect and grow your wealth with custom plans that combine digital assets, stablecoins, and fiat exposure. Our custody solutions ensure regulatory compliance and security.

Institutional trading services

Access deep liquidity, algorithmic execution, and order flow intelligence for BTC and altcoin trading. Designed for hedge funds, prop firms, and high-net-worth entities.

Why Choose Us?

We combine technical depth with market intuition to help clients succeed—whether you’re a crypto beginner or institutional player.

6+ years of industry experience

Since 2018, we’ve been at the forefront of digital asset innovation—navigating crypto winters, bull runs, and regulatory evolution.

Cutting-edge technology and analytics

Our proprietary tools use AI and blockchain intelligence to detect market anomalies and trading opportunities others miss.

Global reach, local expertise

With clients across the U.S., EU, and Asia, we blend international market access with localized compliance and insights from our base in Austin.

Dedicated client success teams

Each client is matched with a crypto advisor and technical analyst to ensure seamless onboarding, strategy alignment, and long-term performance.

Regulatory compliance and transparency

We adhere to U.S. SEC and FinCEN guidelines, maintaining clear audit trails, AML procedures, and third-party custody for all client funds.

Stay Ahead with Expert Insights

Crypto never sleeps—so neither do we. Stay informed with expert-led content that translates complexity into clarity.

Market trends and forecasts

Understand where Bitcoin and crypto markets may be heading with predictive models based on macro events, hash rate cycles, and stablecoin flows.

Economic and sector reports

From regulatory updates in the EU to blockchain sector growth in Asia, our detailed reports help you track opportunities across the ecosystem.

Webinars and expert opinions

Join live sessions with crypto economists, risk managers, and developers offering actionable insights backed by real data.

Real-time financial news

Access breaking crypto news, SEC rulings, ETF developments, and DeFi exploits as they unfold—delivered through our integrated trading dashboard.

Our blog

-

Investment App Business Models: How Successful Apps Generate Revenue

The global fintech revolution has changed how people invest, save, and manage their money. In 2025, investment apps are not just…

-

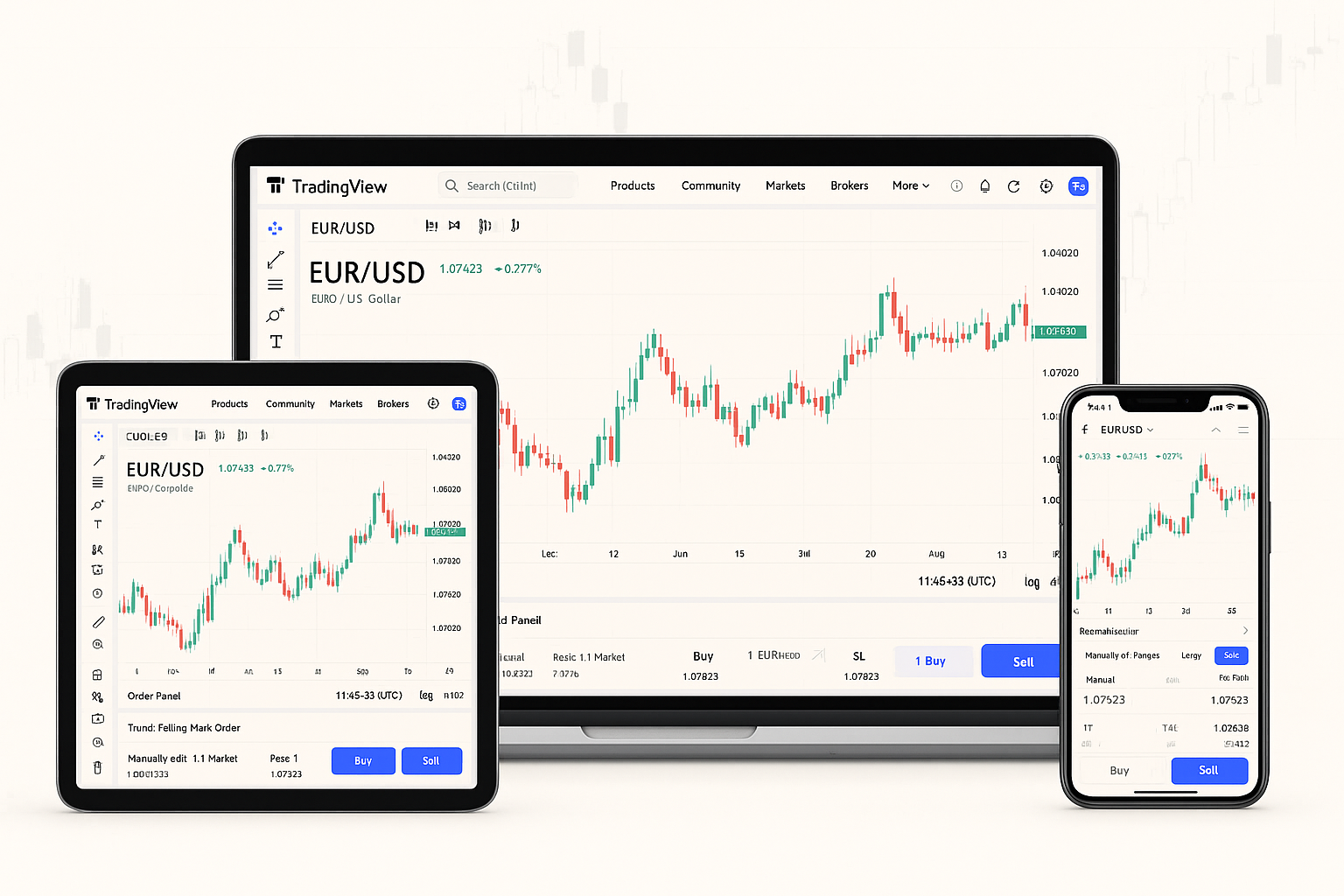

HOW TO TRADE ON TRADINGVIEW: PLATFORM TIPS AND TRICKS

INTRODUCTION TO TRADING ON TRADINGVIEW TradingView has transformed how retail and professional traders access charts, data feeds, and social insights—all in…

-

ETORO COMPETITORS: EXPLORING ALTERNATIVES IN SOCIAL TRADING

INTRODUCTION TO ETORO AND ITS SOCIAL TRADING MODEL eToro pioneered the concept of copy-trading, enabling newcomers to mirror experienced investors’ portfolios…

-

NET GROWTH DEFINITION: UNDERSTANDING FINANCIAL EXPANSION METRICS

What Is Net Growth and Why It Matters Net growth measures the percentage change in a company’s value—typically revenue, profit or…

-

SOFT COMMODITIES TRADING: CAPITALIZING ON MARKET VOLATILITY

Understanding Soft Commodities Trading Soft commodities are agricultural or livestock products that are grown rather than mined, playing a vital role…

-

SWAP CALCULATOR: OPTIMIZE YOUR FOREX POSITIONING

WHAT IS A FOREX SWAP AND WHY DOES IT MATTER? A forex swap (also called rollover interest) is the cost—or credit—applied…